Is My Farm Tax Exempt . this publication explains how the federal tax laws apply to farming. Vat is charged at different rates according to the goods or services involved, but farmers often enter these against the wrong codes on accounting software. agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. You are in the business of farming if you cultivate,. Business property relief (bpr) is similar to apr but not constrained to. Claim vat at the correct rate. the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. above all in general cases an exemption of 50% is available.

from www.exemptform.com

Vat is charged at different rates according to the goods or services involved, but farmers often enter these against the wrong codes on accounting software. You are in the business of farming if you cultivate,. Claim vat at the correct rate. above all in general cases an exemption of 50% is available. this publication explains how the federal tax laws apply to farming. agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. Business property relief (bpr) is similar to apr but not constrained to. the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of.

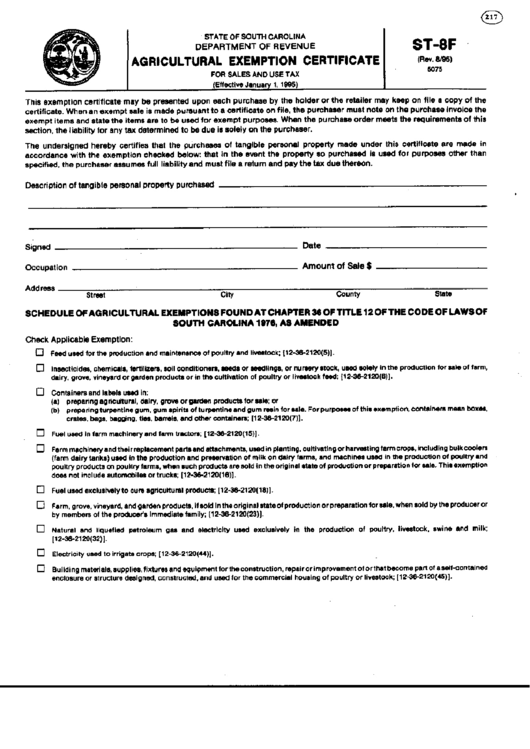

Agricultural Tax Exemption Form Sc

Is My Farm Tax Exempt the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. this publication explains how the federal tax laws apply to farming. the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. Vat is charged at different rates according to the goods or services involved, but farmers often enter these against the wrong codes on accounting software. Business property relief (bpr) is similar to apr but not constrained to. You are in the business of farming if you cultivate,. Claim vat at the correct rate. above all in general cases an exemption of 50% is available. agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn.

From www.exemptform.com

Vermont Tax Exempt Form Agriculture Is My Farm Tax Exempt Business property relief (bpr) is similar to apr but not constrained to. Claim vat at the correct rate. above all in general cases an exemption of 50% is available. agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. Vat is charged at different rates. Is My Farm Tax Exempt.

From legalversity.com

How to Get Tax Exemption for Agriculture Legalversity Is My Farm Tax Exempt this publication explains how the federal tax laws apply to farming. Business property relief (bpr) is similar to apr but not constrained to. Claim vat at the correct rate. You are in the business of farming if you cultivate,. Vat is charged at different rates according to the goods or services involved, but farmers often enter these against the. Is My Farm Tax Exempt.

From www.dochub.com

Louisiana farm tax exemption form Fill out & sign online DocHub Is My Farm Tax Exempt Vat is charged at different rates according to the goods or services involved, but farmers often enter these against the wrong codes on accounting software. this publication explains how the federal tax laws apply to farming. the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. Business property relief. Is My Farm Tax Exempt.

From www.exemptform.com

Farmers Tax Exempt Form Ny Farmer Foto Collections Is My Farm Tax Exempt You are in the business of farming if you cultivate,. agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. Business property relief (bpr) is similar to apr but not constrained to. Claim vat at the correct rate. above all in general cases an exemption. Is My Farm Tax Exempt.

From www.exemptform.com

Agricultural Tax Exemption Form Sc Is My Farm Tax Exempt agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. Business property relief (bpr) is similar to apr but not constrained to. You are in the business of farming if you cultivate,. Claim vat at the correct rate. above all in general cases an exemption. Is My Farm Tax Exempt.

From www.youtube.com

Farm Tax Exemption.. surprise, more complex than it sounds! YouTube Is My Farm Tax Exempt Vat is charged at different rates according to the goods or services involved, but farmers often enter these against the wrong codes on accounting software. Business property relief (bpr) is similar to apr but not constrained to. the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. agricultural tax. Is My Farm Tax Exempt.

From www.exemptform.com

Wv Farm Tax Exemption Form Is My Farm Tax Exempt this publication explains how the federal tax laws apply to farming. agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. Business property relief (bpr) is similar to apr but not constrained to. Vat is charged at different rates according to the goods or services. Is My Farm Tax Exempt.

From www.templateroller.com

Form RVF1308401 Download Printable PDF or Fill Online Application for Is My Farm Tax Exempt Vat is charged at different rates according to the goods or services involved, but farmers often enter these against the wrong codes on accounting software. this publication explains how the federal tax laws apply to farming. Claim vat at the correct rate. Business property relief (bpr) is similar to apr but not constrained to. You are in the business. Is My Farm Tax Exempt.

From www.exemptform.com

Farmers Tax Exempt Certificate Farmer Foto Collections Is My Farm Tax Exempt above all in general cases an exemption of 50% is available. Claim vat at the correct rate. Vat is charged at different rates according to the goods or services involved, but farmers often enter these against the wrong codes on accounting software. You are in the business of farming if you cultivate,. the following discussion looks at the. Is My Farm Tax Exempt.

From www.exemptform.com

Indiana Farm Tax Exempt Form Is My Farm Tax Exempt Business property relief (bpr) is similar to apr but not constrained to. agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. Vat is charged at. Is My Farm Tax Exempt.

From crscpa.com

2023 TN Farm Tax Exemption Is My Farm Tax Exempt this publication explains how the federal tax laws apply to farming. above all in general cases an exemption of 50% is available. agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. Claim vat at the correct rate. You are in the business of. Is My Farm Tax Exempt.

From www.exemptform.com

Form St 8f Agricultural Exemption Certificate Printable Pdf Download Is My Farm Tax Exempt above all in general cases an exemption of 50% is available. this publication explains how the federal tax laws apply to farming. agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. the following discussion looks at the definition of a farmer from. Is My Farm Tax Exempt.

From www.exemptform.com

Farm Tax Exemption Form Oklahoma Is My Farm Tax Exempt agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. above all in general cases an exemption of 50% is available. Business property relief (bpr) is similar to apr but not constrained to. this publication explains how the federal tax laws apply to farming.. Is My Farm Tax Exempt.

From www.exemptform.com

Wv Farm Tax Exemption Form Is My Farm Tax Exempt agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. Claim vat at the correct rate. Business property relief (bpr) is similar to apr but not constrained to. above all in general cases an exemption of 50% is available. You are in the business of. Is My Farm Tax Exempt.

From www.formsbank.com

Fillable Form Reg8 Application For Farmer Tax Exemption Permit Is My Farm Tax Exempt the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. this publication explains how the federal tax laws apply to farming. Business property relief (bpr) is similar to apr but not constrained to. agricultural tax exemptions provide a break at tax time for those who live on property. Is My Farm Tax Exempt.

From www.exemptform.com

Wv Farm Tax Exemption Form Is My Farm Tax Exempt You are in the business of farming if you cultivate,. agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. Vat is charged at different rates according to the goods or services involved, but farmers often enter these against the wrong codes on accounting software. . Is My Farm Tax Exempt.

From srkczxlvdweaq.blogspot.com

How To Get A Farm Tax Exempt Number In Texas Are farmers exempt from Is My Farm Tax Exempt agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. above all in general cases an exemption of 50% is available. this publication explains how the federal tax laws apply to farming. the following discussion looks at the definition of a farmer from. Is My Farm Tax Exempt.

From www.pdffiller.com

Fillable Online assessor tulsacounty FARM TAX EXEMPT NUMBER REQUEST Is My Farm Tax Exempt above all in general cases an exemption of 50% is available. agricultural tax exemptions provide a break at tax time for those who live on property that's used for agricultural purposes or who earn. the following discussion looks at the definition of a farmer from an income tax perspective, including the definitions of. Business property relief (bpr). Is My Farm Tax Exempt.